With the rapid advancement of technology and a global shift toward digital payment methods, contactless payment systems have become increasingly popular in recent years. And with the ongoing pandemic making people wary of physical contact, it’s no surprise that this trend is only going to continue in the coming years.

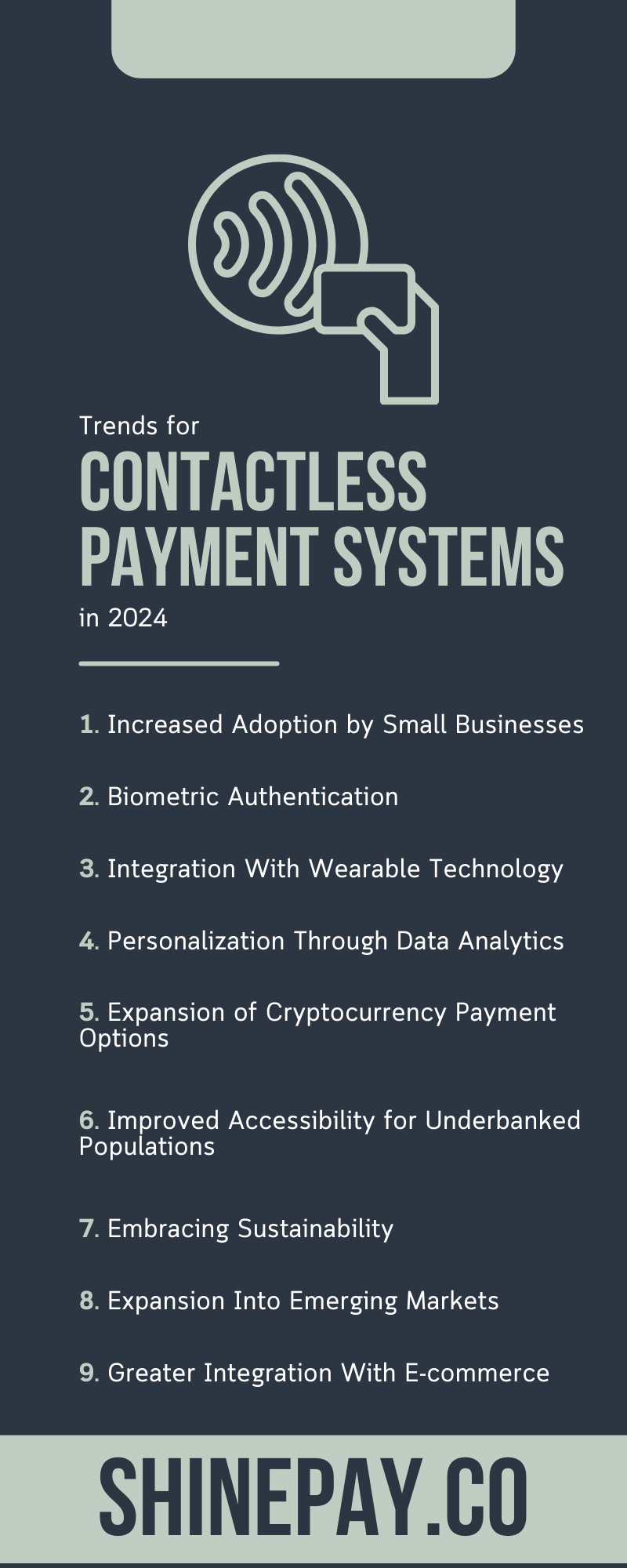

So, what can we expect to see this year in the land of commerce? Let’s take a closer look at the nine trends for contactless payment systems in 2024.

Bye-Bye Cash Payments

Consumers are using cash payments less and less. This trend will continue in 2024. It’s time to embrace the future and get on board with contactless payments. It’s a more efficient and secure way to pay.

1. Increased Adoption by Small Businesses

While larger corporations have widely embraced contactless payments, it’s been slower to catch on with small businesses. However, this is likely to change in the coming years as more consumers demand contactless options for their purchases.

With the ease and convenience of contactless payments, smaller businesses will see the benefits and begin to implement these systems in their operations. It doesn’t matter what type of small business you own; you can utilize a contactless system. Even commercial laundry machines can adapt to them.

2. Biometric Authentication

As security continues to be a top concern for consumers regarding digital payment methods, biometric authentication will become more prevalent in contactless payment systems. This technology allows for secure and convenient transactions using unique biometric identifiers such as fingerprints or facial recognition.

We can expect to see more contactless systems utilizing this advanced security measure to give consumers peace of mind when making purchases in 2024.

3. Integration With Wearable Technology

The rise of wearable technology, such as smartwatches and fitness trackers, has opened a whole new realm of possibilities for contactless payments. We can expect to see more integration between wearable devices and contactless payment systems. Consumers can easily tap their smartwatch against the machine to make a payment. This simplicity would allow for even more seamless and convenient transactions.

4. Personalization Through Data Analytics

As with most things these days, data analytics will play a significant role in the evolution of contactless payments. Payment providers can offer users more personalized experiences by collecting and analyzing consumer data.

This customization could include tailored rewards and incentives, customized payment plans, and targeted promotions. This level of personalization is sure to attract even more consumers to use contactless payment systems.

5. Expansion of Cryptocurrency Payment Options

Cryptocurrencies have been gaining traction in recent years, and it’s only fitting that they will also be a part of the future of contactless payments. We can expect more businesses and payment providers to offer cryptocurrencies as a viable payment option through their contactless systems in 2024.

This payment provides consumers with more options and allows for faster and more secure transactions.

6. Improved Accessibility for Underbanked Populations

Financial inclusion for underbanked populations is one significant benefit of contactless payment systems. We can expect to see even more efforts toward making these systems accessible to the unbanked or underbanked in 2024.

These payments could include prepaid cards or alternative payment methods, making it easier for these individuals to participate in the digital economy.

7. Embracing Sustainability

With more consumers becoming environmentally conscious, businesses are following suit by implementing sustainable practices. Regarding contactless payments, these sustainable practices could include a reduction of paper receipts and encouraging the use of e-receipts or donating to environmental causes with each transaction.

We can expect to see more initiatives toward sustainability within contactless payment systems in 2024, making these systems convenient and socially responsible.

8. Expansion Into Emerging Markets

While contactless payment systems have seen widespread adoption in developed countries, they are still relatively new in emerging markets. But as these markets continue to grow and modernize, we can expect to see a significant increase in the use of contactless payments.

This expansion will provide convenience for consumers and open a whole new customer base for businesses that adopt these systems.

9. Greater Integration With E-commerce

Thanks to the pandemic and companies like Amazon, E-commerce is having its moment. With more people shopping online, there is a natural synergy between contactless payments and e-commerce.

We can expect to see even greater integration between these two areas in 2024. There will be more streamlined and secure payment options offered for those shopping online. This option will further enhance the overall experience for consumers and make it even easier to make purchases with just a tap of a button.

Potential Security Risks for Contactless Payment Systems

While the future of contactless payment systems undoubtedly looks bright, it’s important not to gloss over the potential security risks associated with this technology. Security is paramount when it comes to financial transactions, and contactless systems are not exempt from this.

The threat of data theft is one such risk. As these systems use wireless technology to transmit payment information, there’s a risk that malicious actors could intercept this data. This risk is often called “eavesdropping” and could lead to unauthorized transactions.

Another potential risk is what is known as a “relay attack.” A fraudster could use two devices to extend the contactless range in relay attacks, tricking a payment terminal into believing a card is present when it’s not.

There’s also the risk of lost or stolen devices. Someone else could use a lost or stolen contactless card or device to make unauthorized purchases. While a spending limit exists in a single contactless transaction to mitigate this risk, theft is still a concern.

It’s clear that while contactless payments offer convenience and speed, they also bring about new security risks. However, it’s important to note that the industry is constantly evolving and working hard to address these issues. Biometric authentication, encryption, dynamic data, tokenization, and other advanced security measures are continually being implemented to help protect against these threats and ensure that contactless payment systems are as secure as possible.

Closing Thoughts

The future looks bright for these nine trends for contactless payment systems in 2024, with numerous advancements on the horizon. As businesses and consumers alike continue to embrace this technology, it’s clear that 2024 will be another significant year for the evolution of digital payments.

So, get ready to say goodbye to fumbling for your wallet or handing over cash—the future of payments is contactless, and it’s here to stay. And with these exciting trends in place, 2024 will be an even more convenient and secure year for making purchases. Embrace this trend and tap into a more seamless shopping experience today!