With each passing year, it seems like there are more and more payment solution types for merchants to choose from. Gone are the days of most people paying in cash. Instead, we use contactless credit cards, apps, and digital wallets.

If you’re not accepting these modern forms of payment, you’re likely losing a huge number of potential customers. By some estimates, over two billion people used some form of mobile payment in 2022 alone, and that number is already rising.

One of the fastest-growing trends is the QR code payment method. Keep reading to learn what QR code payments are and how they work.

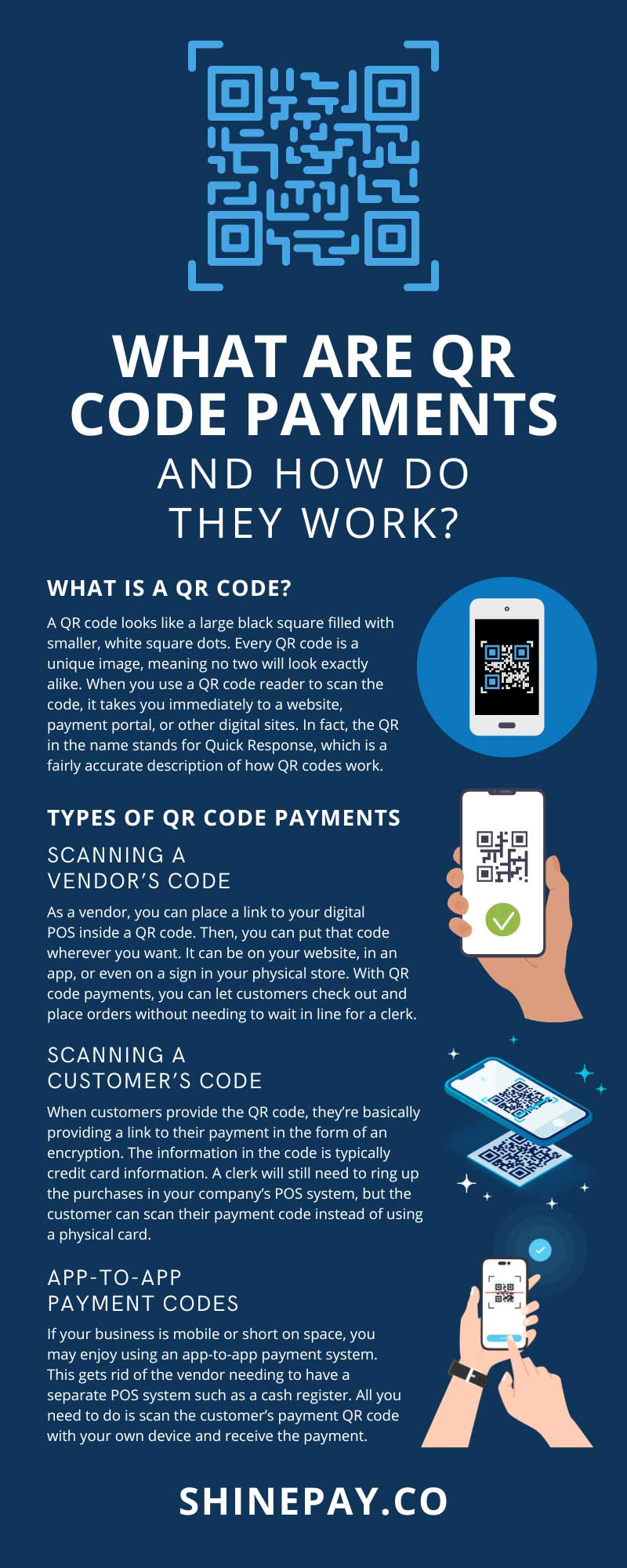

What Is a QR Code?

A QR code looks like a large black square filled with smaller, white square dots. Every QR code is a unique image, meaning no two will look exactly alike. When you use a QR code reader to scan the code, it takes you immediately to a website, payment portal, or other digital sites. In fact, the QR in the name stands for Quick Response, which is a fairly accurate description of how QR codes work.

Most people just need a smartphone with a camera app to scan a QR code. While there are plenty of apps out there that will scan QR codes, you don’t really need one. These days, most camera apps will do it for you. All you have to do is hold your phone’s camera over the code for a second or two; then, you can click on the link that pops up.

The History of QR Codes

A Japanese company called Denso Wave is responsible for creating the QR code in the 1990s. At its inception, the QR code was mainly another industrial tool for tracking shipments, like the barcode. Then things started to take off in China, where mobile payment companies latched onto the idea of using QR codes for payment processing. In fact, QR code usage in China was strong even before the COVID-19 pandemic.

Meanwhile, in other countries, the QR code was really just a way for people to link information. Think of it like a hyperlink that you can click in real life. You might put a QR code on a flyer for an event so people can access your webpage.

Post-Pandemic QR Code Usage

After the pandemic, QR codes gained enormous popularity across the world as a contactless payment solution. Unlike tap-and-go credit cards, you don’t even have to come face-to-face with a person or touch a public POS system to use a QR code. Contactless payments also made no-contact delivery ideal.

The use of QR codes by restaurants and food service vendors is a huge part of the reason why QR codes are so popular. Not only can you pay for a delivery using a QR code, but in many countries, you can scan your receipt to pay for a meal. Many restaurants also use QR codes to save on paper menus.

The Advantages of QR Code Technology

If you’re a merchant trying to figure out what kinds of payment solutions are best for your business, you’d be wise to consider QR code technology. Take a look at some of the advantages of using QR codes:

- Ability to store more information than traditional barcodes.

- Ability to scan on screens as well as paper.

- QR codes are readable even when damaged.

- Ability to encrypt information.

Encryption and the information code’s size are two of the characteristics that make QR codes so useful for payment solutions. Encryption with QR codes is basically like putting the data into your own private language, one that only your software can decode. That way, only your company can use the QR code to receive payments or transfer information.

Scanning from paper and screens is another thing that sets QR codes apart from traditional barcodes. This ability to scan anywhere enables people to pay with their phones using a number of different methods, which we’ll break down in the next section.

Types of QR Code Payments

Now that you understand what QR code payments are, it’s time to explain how they work. Thanks to the versatility of QR codes, there are many ways for businesses to use them to navigate payments. There are three main types that we’ll explain below.

Scanning a Vendor’s Code

As a vendor, you can place a link to your digital POS inside a QR code. Then, you can put that code wherever you want. It can be on your website, in an app, or even on a sign in your physical store. With QR code payments, you can let customers check out and place orders without needing to wait in line for a clerk.

There’s even more potential if you pair QR codes with your own app. This way, you can let customers save their information and even gain loyalty points for future transactions.

Scanning a Customer’s Code

When customers provide the QR code, they’re basically providing a link to their payment in the form of an encryption. The information in the code is typically credit card information. A clerk will still need to ring up the purchases in your company’s POS system, but the customer can scan their payment code instead of using a physical card.

App-to-App Payment Codes

If your business is mobile or short on space, you may enjoy using an app-to-app payment system. This gets rid of the vendor needing to have a separate POS system such as a cash register. All you need to do is scan the customer’s payment QR code with your own device and receive the payment.

QR Codes for Laundry Services

QR codes are incredibly useful for laundry service providers, both laundromats and apartment laundry rooms. With ShinePay’s contactless payment app, all you have to do is install our Bluetooth devices in your machines and put a QR code on each one. With the Bluetooth device installed, your customers don’t even need to rely on Wi-Fi services to do their laundry.

The best part is that you get to track all of your payments in our intuitive vendor dashboard. You can even track information across multiple locations and generate reports whenever you want. With our technology, you can collect and track digital and coin payments in the app. Contact ShinePay today to find out how we can help bring your laundry business into the 21st century.